A LESSON IN STRATEGY & EXECUTION

How DoorDash Built the Most Incredible Go-to-market Playbook Ever

Sifting through the DoorDash S-1: Building an economic moat by combining execution with data and intelligence.

There’s plenty of financial analysis of the DoorDash S-1 out there. But no analysis so far has focused on how exactly DoorDash went from last to first in a super competitive market — and the answer includes “by using data”.

DoorDash interlocked its operating model with their technology platform, making execution driven by data the key drivers that propelled DoorDash from 17% to 50% marketshare between January 2018 and October 2020.

I think there are three distinct factors that make up for DoorDash’s success:

- A clear strategy and operating model

- A relentless focus on execution — 1% better every day

- A data platform that drives intelligence and automation

It’s the 3rd factor that I think gets too little attribution — data. That’s what this post is about, and there’s a tiny section on page 194 of the prospectus that touches on it:

“We have assembled a team of 617 highly skilled engineers, designers, and computer scientists whose expertise spans a broad range of technical areas, as of September 30, 2020. We organize our team with a full-stack development model, integrating product management, engineering, analytics, data science, and design.”

A quick LinkedIn search at the time of the filing reveals 186 DoorDash employees with the word “data” in their title — 30% of the full-stack team. That’s a lot, in the range of 2–3x higher than what I see with other engineering organizations. Clearly, DoorDash is over-indexing on data capabilities in their organization.

Food delivery is a low margin business, and besides brand you could argue there’s not much differentiation between two delivery services — they pick up food from a merchant and deliver it to a consumer.

By using data, DoorDash has been squeezing out the smallest inefficiencies out of its operating model, increasing customer / Dasher / merchant satisfaction, marketplace gross order volume (“GOV”) and customer lifetime value.

Yes, others are using data too. At my previous company intermix.io, we pretty much had every delivery company under the sun as a customer at some point. Postmates, Takeaway.com, Delivery Hero, Glovo, Deliveroo — you name it. All with excellent data engineering teams.

But DoorDash takes the cake in my opinion. With data from the over 900 million orders that have been completed through the platform since founding, they’ve made it more efficient and profitable to deliver food from A to B than anybody else.

If you don’t have the time to read the full post — I also write a weekly-ish newsletter where I share the lessons learned from all the start-up that I come across. 👇

A Clear Strategy and Operating Model

The DoorDash operating model aka “Flywheel” connects — at the point of the publication of the S-1 — the three marketplace constituencies:

- 390,000 merchants

- 18 million consumers

- 1 million dashers

What’s remarkable that this model has both network effects and economies of scale.

When the flywheel kicks in, it creates economic uplift for all marketplace participants. The image below shows that the economics of a single order can look like.

Everybody wins with more order volume on the platform. That makes the strategy and its key activities clear:

- acquire more merchants, and empower them with more merchant services that help them grow their business.

- acquire more customers, and offer them a restaurant selection and services that drive up engagement and retention.

- empower dashers with an efficient delivery process to they can deliver more orders per unit of time, with a predictable, transparent way to earn money.

And looking at Marketplace GOV, clearly that flywheel has worked, with $7.3 billion in in GOV in Q3 2020 alone.

Conventional wisdom in the food delivery business suggests that the biggest markets are in high-density metropolitan areas. Because of their high density, you have more restaurant choice, shorter distance to the consumer, and a higher number of single young professionals with a high amount of disposable income that they prefer to spend on ordering dinner, not cooking it.

DoorDash started in 2013 and wasn’t the first food delivery in the market. Postmates started in 2011. Eat24 started in 2012, and was acquired by Yelp, and then re-sold to GrubHub. GrubHub itself started in 2004. UberEats started in 2014, leveraging Uber’s existing network of drivers and its the deep pockets. So there was plenty of well-funded, existing competition.

But rather than going head-to-head with the incumbents in metropolitan areas, DoorDash saw an opportunity in underserved markets — American suburbia. From the S-1:

“We believe that suburban markets and smaller metropolitan areas have experienced significantly higher growth compared to larger metropolitan markets because these smaller markets have been historically underserved by merchants and platforms that enable on-demand delivery. Accordingly, residents in these markets are more acutely impacted by the lack of alternatives and the inconvenience posed by distance and the need to drive to merchants, and therefore, consumers in these markets derive greater benefit from on-demand delivery. Additionally, suburban markets are attractive as consumers in these markets are more likely to be families who order more items per order. Lighter traffic and easier parking also mean that Dashers can serve these markets more efficiently. “

Turn’s out DoorDash’s Ideal Customer Profile wasn’t just the “Millennial Young Professional in the City”, but also the “All-American Family in Suburbia” where both parents are working and don’t have much time (or desire) to cook.

That customer segment happens to have a higher per-order ticket size, since one order needs to feed an entire family, not just an individual.

The lower density of suburban areas turns out to be an advantage, because of less traffic and better parking. DoorDash says they have a 58% market share in the suburbs, higher than their overall market share.

Because of less choice in those markets, customers also stick around with DoorDash and don’t churn to other delivery services. As you can see from the image below, repeat purchase from existing customers drove 85% of GOV in Q3.

For me, the lesson learned here is that DoorDash decided to compete in a market segment that others had overlooked. And that segment happened to come with some interesting economics:

- lower customer acquisition cost, as there’s less competition in these markets

- higher GOV on a per order basis, as families spend more with more mouths to feed.

- higher retention, as customers don’t have an alternative to switch to (and actually enjoy the service)

Maybe that strategy was intentional, maybe they stumbled on it. Probably a bit of both. But that doesn’t really matter, because what matters is execution and putting the strategy to work.

A relentless focus on execution

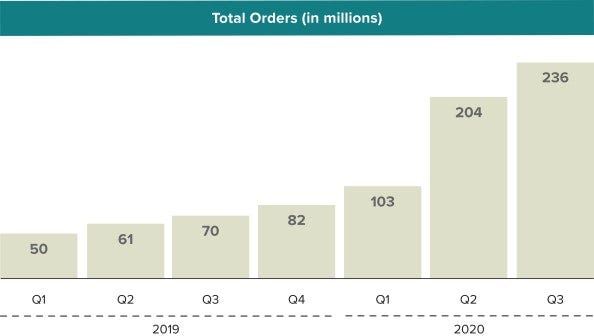

We already covered Marketplace GOV above. Peeling the onion from the top line, the numbers of orders have grown as DoorDash rolled out more markets, and then there’s a clear uplift from Covid in Q2 2020.

I plotted the number of orders vs. GOV below. The average order value has fluctuated within a narrow band, between $29.90 and $31.20. That makes intuitive sense, as people can only eat that much.

The insight here I think is that it will be hard if not impossible to grow the business by increasing the average order size, e.g. via marketing, promotions, etc. It’s a fixed amount that may grow with inflation, but that’s it. Apart from new products, that means there only three ways to grow the top- and bottom-line of the business:

- roll out more markets

- increase order volume per market and customer

- make each market and order more efficient.

And that’s exactly what DoorDash has done.

Roll out more markets

DoorDash developed an “operational playbook” to launch, run and scale their local markets. Most of that responsibility sits within the Strategy & Operations team.

DoorDash runs seven regions across the U.S. and Canada. Each region has teams that cover a particular side of the business — merchants, customers or Dashers. Their goal is to scale all three at the same rate. The combination of regional experts and focus on each side of the business ensures that local marketplaces within the regions are growing and running smoothly.

Within the Strategy & Operations team, DoorDash has a team of “Launchers“ that work with all three sides of the platform to roll out a new market:

- recruit restaurants as partners

- kick off marketing efforts to bring in customers

- run orientations for new Dashers.

Before launching, the team of Launchers conducts demographic research in that market, and will literally go door-to-door to engage with merchants. Based on their research, they bring on the most desirable merchants. The whole process takes six to eight weeks.

Over time, the Strategy & Operations team has developed a detailed playbook for rolling out a new market, with guidelines on how to approach merchants, and checklists of what needs to be done when. From there, DoorDash also provides education for merchants, e.g. how to optimize their dishes for delivery and pick-up, or what to do to attract new customers.

The Launchers walk the talk — they do deliveries themselves. As does the entire DoorDash organization. From page iii of the S-1 filing, in the “How We Operate” section:

“[…] everyone at DoorDash, including me [Tony Xu], tries to step out of our day-to-day roles once a month to do a delivery or engage in customer support, menu creation, or merchant support — staying very close to the needs of those who use our platform is key. We attribute our category-leading spend retention and capital efficiency, in part, to this obsession

Increase order volume per market and customer

Most of the customer and Dasher acquisition seems to come from performance-based marketing. There’s a dedicated Customer Acquisition Team with a business leader.

Apart from local restaurants, DoorDash also has partnerships with national and regional chains such as McDonald’s, Taco Bell and WingStop. Other initiatives include co-marketing deals with e.g the NBA.

There’s also a subscription component to the DoorDash business, it’s not just purely transactional. With “DashPass”, customers pay a flat monthly delivery fee (today $9.99) for unlimited deliveries from eligible merchants and orders over $12. Amazon Prime and a Costco membership come to mind, for a comparison. As of September 30, 2020, DoorDash had over five million consumers on DashPass, meaning they generate $50M+ in monthly subscription revenue, without having delivered a single meal yet. Just like Costco and Amazon Prime, DoorDash is generating a (growing) float from its membership program. But more so — DashPass takes friction of the ordering process, as there’s no additional delivery fee. It makes people order more.

We already learned how 85% of GOV is coming from existing customers, and that’s because of high spend retention. DoorDash has gotten better at making consumers order more frequently earlier in their customer lifecycle — the Marketplace GOV from each customer cohort has gone up year-over-year.

You can see how cohorts consistently increase their spend on DoorDash.

- The 2016 cohort increased its annual spend by 57% in Year 4 (2019) compared to 2016.

- The 2018 cohort increased its annual spend by 65% in Year 2 (2019)

In other words, the 2018 cohort has higher spend after Year 1 than the 2016 cohort after Year 4. The compounding impact on the business is tremendous, because DoorDash is generating organic growth without spending more on customer acquisition.

If you assume an average of 1.6x across the three cohorts [(1.57 + 1.62 + 1.65) / 3 = 1.61] for the next three years, that means we’ll be looking at 4.1x cumulative GMV. That’s a ton of operating leverage and drives up the LTV / CAC ratio.

Make each market and order more efficient

Another interesting part from the “How We Operate” Section is the “Get 1% better every day” mantra.

We are only as good as our next order. […] we must perennially improve our products, create more customer value, and launch new services to meet the needs and expectations of our three constituencies. […] While it might seem small in isolation, our daily work — be it on reducing delivery times, increasing efficiency, or improving personalization — is about compounding incremental improvements that drive significant value over time.

“Compounding incremental improvements” — looking at the evolution of the business, that approach seems to have worked for DoorDash, by looking at aggregate numbers.

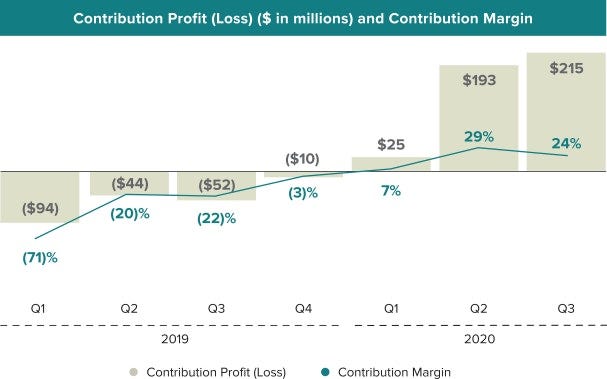

First off, Gross Margin grew from 23% in Q1 2019 to 53% in Q3 2020.

Then, Contribution Margin went from deep red in Q1 2019 (-71%) into the black in Q1 2020 and is now in the 24% range at the the end of Q3 2020. Same story for Contribution Profit.

So why is that? It’s the operating flywheel kicking in, see page 112 of the S-1:

“Contribution Profit (Loss) as a percentage of Marketplace GOV has improved over time as our overall cost structure has become more efficient due to operational and technological enhancements. These enhancements have focused on improving Dasher efficiency, which enables Dashers to complete more deliveries per hour worked, and the quality of the experience of merchants, consumers, and Dashers, which has led to lower cost of refunds, credits, and adjusted cost of revenue, in the aggregate, as a percentage of Marketplace GOV.”

So there you go. More deliveries per hour worked, better experience, less loss.

That’s the aggregate picture. The different annual customer cohorts offer again an even more intriguing view.

DoorDash spends between 7% (2017 Cohort) and 10% (2018 Cohort) of Marketplace GOV on customer acquistion in Year 1. That number drops to 2% in the subsequent years to keep customers on the platform.

Looking at the Contribution Profit by Cohort, we can see how “due to the adjusted sales and marketing and promotions spend required to acquire the consumers in the cohort and encourage their repeat use of our platform”, we see a Contribution Loss in Year 1, between 5% (2017 Cohort) and and 9% (2018 Cohort).

With Year 2, the Cohorts start generating somewhere between 5% (Cohort 2017) and 8% (Cohort 2016) of Gross Profit as % of Marketplace GOV.

In summary, here are the things we know:

- Customer acquisition cost (CAC) is between 7–10% of GOV in Year 1. Let’s assume 8% for simpler math.

- Contribution Profit (CP) is around 5–8% of GOV for the following years. Again, let’s assume 8% for simpler math.

- Customers stick around for at least 3 years, with spend growing to 1.6x

Since all these metrics are expressed as a function of GOV, we can calculate a few metrics:

- 12 months payback period. If you divide the customer acquisition cost of Year 1 by the contribution profit of Year 2, you get a payback period of 12 months → 8% / 8% = 1.

- 24% of GOV Customer Lifetime Value. If you assume a customer lifetime of 3 years, you get 3 x 8% = 24% of GOV in Customer Lifetime Value (CLV).

- 3x CLV / CAC Ratio. → 24% / 8% = 3x

These metrics are only expressed in a percentage of GOV. Because of the 1.6x increase in spend, the absolute numbers for lifetime value go up, and contribute in cash to the bottom line. All DoorDash needs to do is acquire a customer and keep them on the platform beyond year 1.

I know there’s a bit of wiggle room in the math since we rounded the numbers a bit, but overall this looks like a pretty damn good business to me.

So how exactly are they doing this? This is where their technology platform comes into play.

A data platform that drives intelligence and automation

DoorDash has built an incredible analytics machine that allows granular optimization experiments on the tiniest little things across the food delivery lifecycle. At DoorDash, data is what drives the “Get 1% better every day” goal.

From the S-1:

Our local logistics platform is powered by our proprietary technology that carefully optimizes the many interactions between merchants, consumers, and Dashers to make the end-to-end experience seamless and delightful. Each order on our local logistics platform provides a broad range of information that is analyzed by our machine learning algorithms to improve the quality and performance of our platform. From presenting personalized, curated content to consumers that takes into account cuisine and dietary preferences to providing information that enables Dashers to maximize their earnings opportunities, our machine learning algorithms continuously improve the experiences of our three constituencies and make our local logistics platform more intelligent and efficient with every order.

Any industry has a key transaction that measures the exchange of value. Airlines sell plane tickets, Brokerages sell stock trades, Logistics companies sell shipments, Food Delivery sells restaurant orders, and so forth.

- Analytics teams “instrument” each transaction to collect data that helps answer basic questions about the business. For airlines, that may be “how many tickets did we sell in March?”. In food delivery that could be “how many orders did we sell yesterday?” or “which is the the most popular restaurant in Austin in July vs. December?”

- Over time, analytics teams collect more data points, incl. from the events that happen pre- and post-transaction. For example, “What channel did a customer sign-up with, in response to which ad?”, “what type of phone do they use?”, or “what type of credit card do they use to pay?”

- Good analytics teams collect that data in a way so that they can slice and dice that data in any possible way. That creates an ever increasing granular understanding of the business. Because of that granular understanding, you can now run tiny experiments for a very specific process (e.g. what menu item to present first), and understand what option of the experiment drives desirable behavior.

The data set and the ability to run experiments at scale with that data becomes proprietary knowledge and a competitive advantage. Your platform becomes intelligent.

DoorDash has done exactly that. Their data platform is a growth engine that powers experimentation across the food delivery lifecycle — ad images, menu presentation and pick-up time for Dashers by market, down to the single minute depending on weekday and time of the day.

Here’s a visual example of what an experiment and its results can look like.

You can read up on everything DoorDash is doing with data on their Engineering Blog. A few examples.

Optimizing Dasher dispatch

One of the biggest levers for a profitable delivery business is driver dispatch — which dasher is best suited to fulfill a delivery. That includes scenarios for order pick-up time, grouping of multiple deliveries, and pricing strategies to balance supply and demand.

Clearly, it makes a difference if a whole delivery cycle takes e.g. 30 min or 20 minutes — a Dasher can deliver more orders per hour, and also makes more money. Shaving off minutes compounds across the whole fleet, raising income for Dashers and making DoorDash more efficient and profitable.

Online delivery menu best practices

The “ticket size” of an order obviously matters as the restaurant generates more revenue, and DoorDash gets a larger commission, which they can re-invest into the business.

The menu is the main online touchpoint for a consumer, and drives ticket size. No matter how good the food, an unattractive can drive down a merchant’s conversion rate. , regardless of the quality of the food. If a merchant does not design its menu correctly, customers won’t be as attracted to their online offerings and will not buy as often. In order to succeed online, merchants need to utilize a set of menu-building best practices to attract new customers.

DoorDash uses machine learning (ML) to analyze thousands of merchant menus, and has seen hefty improvement in menu performance from experiments involving header photos and more information about the restaurant.

Real-time prediction service — “Sybil”

The best data is useless when you can’t put it to action. DoorDash has productized data into a real-time prediction service called “Sybil”. Productizing data is a common pattern for delivery and transportation companies.

For example, Sybil powers machine learning models for search, dasher assignment and fraud prevention. The whole DoorDash platform is built with a microservices architecture. Consider a prediction a data microservice that any DoorDash app can call, and automate decisions based on real-time data, vs. static rules.

DoorDash has again a competitive advantage here — they have more customers and orders, across more markets, hence they have a better data set to power their machine learning algorithms. As a result, much of the DoorDash marketplace is now driven by data. Data makes the DoorDash ”local logistics platform more intelligent and efficient with every order”. It’s a huge competitive data moat. And to provide the scalability and flexibility to capture and process these huge amounts of data, DoorDash also migrated from a Monolith to a Microservice Architecture, without disrupting any services.

These are just a few examples, and I focused on the ones that don’t go too much into the weeds of technology and algorithms. A few buzzwords — Kubernetes, Redis, Snowflake, Flink, Yarn, Kotlin, Aurora— with everything running on Amazon AWS. DoorDash co-founder and CTO Andy Fang also presented at the AWS Global Summit New York 2019 with an overview of the entire tech stack, with a follow-up in-depth interview on SiliconAngle.

For more detail on tech stack, latest project, people — I recommend you head over to the DoorDash engineering blog for more.

Lessons learned

There are three distinct lessons learned from the DoorDash S-1.

- You don’t need to be first-to-market. It’s much more important to find a segment with an unmet need that you can serve with a better product, expanding the market. For DoorDash, that were families in the suburban markets. Serving that segment allowed DoorDash to grow, build a brand and gain overall market share.

- Find a repeatable model. The first deliveries were done by the founders. From there, they industrialized the delivery process, with a clear operating model and understanding of their customer economics. The operating model produces a predictable lifetime value for each incremental $1 of customer acquisition spent. That allowed DoorDash to raise more money than anyone of their competitors, and use that funding to outrun everybody else.

- Build an economic moat with data. Food delivery is a commodity business and highly competitive. That’s why all delivery companies try building a brand, incl. DoorDash. But DoorDash also generated a huge proprietary data set that they used to make their operations more efficient, generate more marketplace transaction volume and create economic lift for all marketplace participants — merchants, Dashers and consumers. The secret is less in using data, but the decision to dedicate almost a third of all engineering resources to working with data.

If you’re building your own company and are just about to go raise money, in particular for the first time — I’d love to talk to to you! You can best reach me on LinkedIn.

Finally, I also write a weekly newsletter on Substack where I share the lessons learned from all the start-up that I come across.

Click the link below to head over to Substack and subscribe!👇